Twitter IPO / Who Buyin?

- Thread starter StillHustlin

- Start date

Sold everything today on the new nafta news. Hefty rips and some baby losses. I’m cash heavy and excited for the next play.

Props:

StillHustlin

https://m.scmp.com/news/asia/southe...-suffer-more-trade-war-china-alibabas-jack-ma

US will ‘suffer more’ in trade war with China: Alibaba’s Jack Ma

Cold-war style offensive by America is an ill-advised miscalculation that will cause pain ‘all over the world’, warn top executives of Chinese conglomerate

US will ‘suffer more’ in trade war with China: Alibaba’s Jack Ma

Cold-war style offensive by America is an ill-advised miscalculation that will cause pain ‘all over the world’, warn top executives of Chinese conglomerate

Today is the anniversary of the end of the 1929 crash

https://en.m.wikipedia.org/wiki/Wall_Street_Crash_of_1929

https://goo.gl/images/Scc6hX

https://en.m.wikipedia.org/wiki/Wall_Street_Crash_of_1929

https://goo.gl/images/Scc6hX

China,United States : Richemont and Alibaba to Collaborate in Online Luxury Market https://www.marketwatch.com/press-r...ollaborate-in-online-luxury-market-2018-11-02

Article points out that Alibaba jumped in this space due to JD jumping in earlier.

Article points out that Alibaba jumped in this space due to JD jumping in earlier.

Alibaba’s Singles Day sales dwarf Amazon’s biggest day https://www.theverge.com/2018/11/12/18086966/alibabas-singles-day-sales-dwarf-amazons-biggest-day

Alibaba’s 10th annual Singles Day sale, which took place yesterday on 11/11, racked up $30.8 billion in sales and set a new record for the platform, reports CNBC. The figure represents a 27 percent year-on-year rise over 2017’s total of $25.3 billion, and was helped in part by the e-commerce giant’s expansion into in-store retail, combined with China’s large and tech-savvy middle class.

Alibaba’s 10th annual Singles Day sale, which took place yesterday on 11/11, racked up $30.8 billion in sales and set a new record for the platform, reports CNBC. The figure represents a 27 percent year-on-year rise over 2017’s total of $25.3 billion, and was helped in part by the e-commerce giant’s expansion into in-store retail, combined with China’s large and tech-savvy middle class.

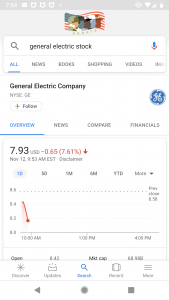

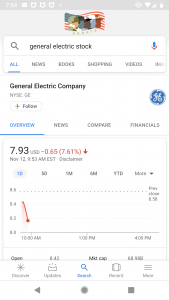

GE is looking more and more foolish as the days go by (former business unit they sold off now being acquired for nearly 6bil)

https://www.marketwatch.com/story/athenahealths-stock-jumps-after-buyout-deal-confirmed-2018-11-12

BTW, looks like GE is headed below 8 if you want to sell short with a trailing stop %

*I own no positions in GE. My short term outlook is BEARISH. My 5 year outlook is HOLD.

https://www.marketwatch.com/story/athenahealths-stock-jumps-after-buyout-deal-confirmed-2018-11-12

BTW, looks like GE is headed below 8 if you want to sell short with a trailing stop %

*I own no positions in GE. My short term outlook is BEARISH. My 5 year outlook is HOLD.

My BLINDFOLD BUY of the week would be WLL. I foresee a $4-$10 inc. in price (my 3mos PT would be $41, but I do believe it can trend to new 52-wk high). Pay attention to OPEC. If I was to play this, it would be a 5% trailing stop. Keep in mind, I am not a fiduciary and do not give professional advice, just my own beliefs, opinions, whims, and due diligence. Am I buying WLL today? No. Do I have a position in WLL? No.

GE is looking more and more foolish as the days go by (former business unit they sold off now being acquired for nearly 6bil)

https://www.marketwatch.com/story/athenahealths-stock-jumps-after-buyout-deal-confirmed-2018-11-12

BTW, looks like GE is headed below 8 if you want to sell short with a trailing stop %

*I own no positions in GE. My short term outlook is BEARISH. My 5 year outlook is HOLD.

https://www.marketwatch.com/story/athenahealths-stock-jumps-after-buyout-deal-confirmed-2018-11-12

BTW, looks like GE is headed below 8 if you want to sell short with a trailing stop %

*I own no positions in GE. My short term outlook is BEARISH. My 5 year outlook is HOLD.

Why is DIS a buy?

The other day I'm watching CNBC as I do about three-four days per week thanks to the innernet. Kevin OLeary was panel guest and was asked about DIS. What he said isn't relevant. While chatting, they flashed NFLX across screen.

If you compare prices of DIS and NFLX, you will see NFLX costs ~3x as much to buy per share. If you look at shares outstanding, you will see DIS is at ~3x the amount of outstanding shares (simple supply demand surface overview). This makes sense.

Maybe comparing DIS and NFLX is not making any sense to you right now. Wait a minute. DIS streaming service revenue, which does not exist until 2019, had not been calculated into DIS price yet.

While NFLX is only streaming content, DIS is so much more, not to mention a easy Wall Street bet that is already valued equivalent to such a big market player as NFLX.

I personally am targeting a PT of $230/sh for Disney (this means my PT for NFLX is $345 as of 9:22 AZ TIME), once DISNEY streaming value has been realized. Now, understand that this may not be realized until HULU can no longer stream content owned by DIS.

*These are the authors opinions only. The author holds no direct positions in DIS, but is beginning accumulation phase of both BUY and CALL. Please seek a fiduciary for any professional investment advice. There are many other financial indicators including P/E that must be evaluated before making market decisions.

The other day I'm watching CNBC as I do about three-four days per week thanks to the innernet. Kevin OLeary was panel guest and was asked about DIS. What he said isn't relevant. While chatting, they flashed NFLX across screen.

If you compare prices of DIS and NFLX, you will see NFLX costs ~3x as much to buy per share. If you look at shares outstanding, you will see DIS is at ~3x the amount of outstanding shares (simple supply demand surface overview). This makes sense.

Maybe comparing DIS and NFLX is not making any sense to you right now. Wait a minute. DIS streaming service revenue, which does not exist until 2019, had not been calculated into DIS price yet.

While NFLX is only streaming content, DIS is so much more, not to mention a easy Wall Street bet that is already valued equivalent to such a big market player as NFLX.

I personally am targeting a PT of $230/sh for Disney (this means my PT for NFLX is $345 as of 9:22 AZ TIME), once DISNEY streaming value has been realized. Now, understand that this may not be realized until HULU can no longer stream content owned by DIS.

*These are the authors opinions only. The author holds no direct positions in DIS, but is beginning accumulation phase of both BUY and CALL. Please seek a fiduciary for any professional investment advice. There are many other financial indicators including P/E that must be evaluated before making market decisions.

Last edited: